PEC 45/2019 and the Tax Matrix in Microsoft Dynamics AX \ 365

PEC 45/2019 is already in the hands of the Brazilian Federal Senate, more popularly known as tax reform. But the question is: what will be the impacts of this tax reform on Microsoft’s ERP tax calculation engine?

Nowadays, the complexity of setting up and managing the tax matrix, depending on each type of business, can be a daunting task for consultants and users. As much as the system facilitates this task by allowing groupings to be made, thereby reducing configuration records, the complex Brazilian tax system itself does not allow this task to be even easier and this directly affects business productivity. In many projects we come across a variety of different tax scenarios that sometimes complicate the lives of project stakeholders, and now will everything be resolved by the reform?

The answer is Yes and No, let’s see:

🤔

Over the time the tax system was undergoing “patches” in order to meet regional interests that allowed the development of certain Uf’s federation, such as the famous “Manaus Free Zone”. Due to this strategy, the so-called “Fiscal War” was created where the Uf’s began to offer tax benefits to entice companies to settle in their regions. If we analyze from the point of view of income distribution, it may seem that the strategy was right, but then the question comes, really?

According to the economist Bernard Appy, “The distribution system of large retailers and consumer goods producers is built on tax benefits, but this system maximizes the cost of logistics, in other words, there is too much logistics cost and trucks running due to the reduction of taxes for companies “, that is, it affects the productivity of the whole production chain.

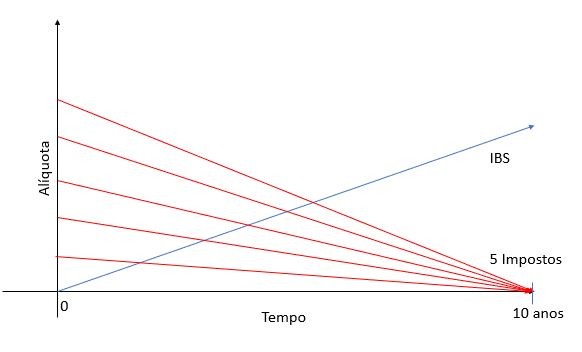

Returning to the purpose of this article, under a simplistic view, the proposal, if kept as it is, provides that five taxes, namely PIS, COFINS and IPI (federal), ICMS (state) and ISS (municipal) to be replaced by a single tax. called IBS (Taxes on Goods and Services), but this will happen gradually over 10 years so that the Uf’s can be organized during the period, in other words, as the rate of IBS increases the 5 taxes will have the rates gradually reduced to their extinction.

The chart below outlines how the transition will occur:

Consultants and Users, fasten your seat belts and prepare to add a new tax code to the tax groups and to make rate adjustments.

In summary, if the proposal is approved the way it is, we will have work to adapt the tax matrix, but after the transition time, when IBS is the only tax in the chain, we are sure to have an improvement in deployments and management of the Tax Matrix.

Just as an addendum, the current proposal does not deal with income taxes (IRPJ and CSLL).

See you guys, see you in the next posts.

About the Author

Helio Menezes

Helio is a Microsof Dynamics AX \ 365 for Finance & Operations Certified Solution Architect with a financial background and has recently worked as a Functional Financial Advisor to retail clients.

Want to learn more about tax matrix in Microsoft Dynamics ERP?

Other blog post you may want to read: